trust capital gains tax rate australia

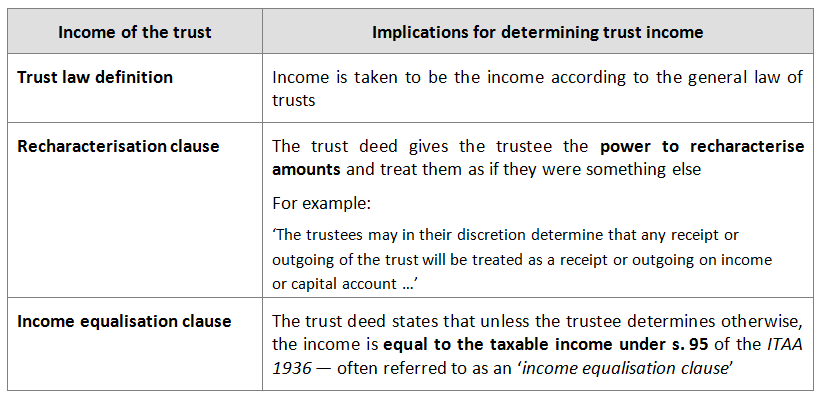

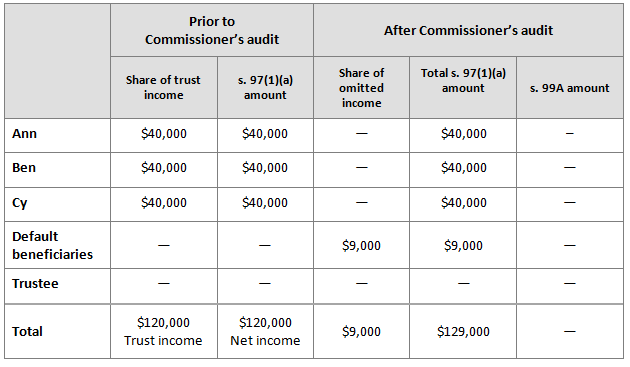

S97 98A 98that share of the net income of the trust estate. Investments of less than 30 of the equity in an ESIC would generally qualify for a 20 non-refundable tax offset capped at AU200000 per investor including any offsets carried forward from the prior years investment and a 10-year tax exemption on any capital gains arising on disposal of the investment.

Trust Tax Rates 2022 Atotaxrates Info

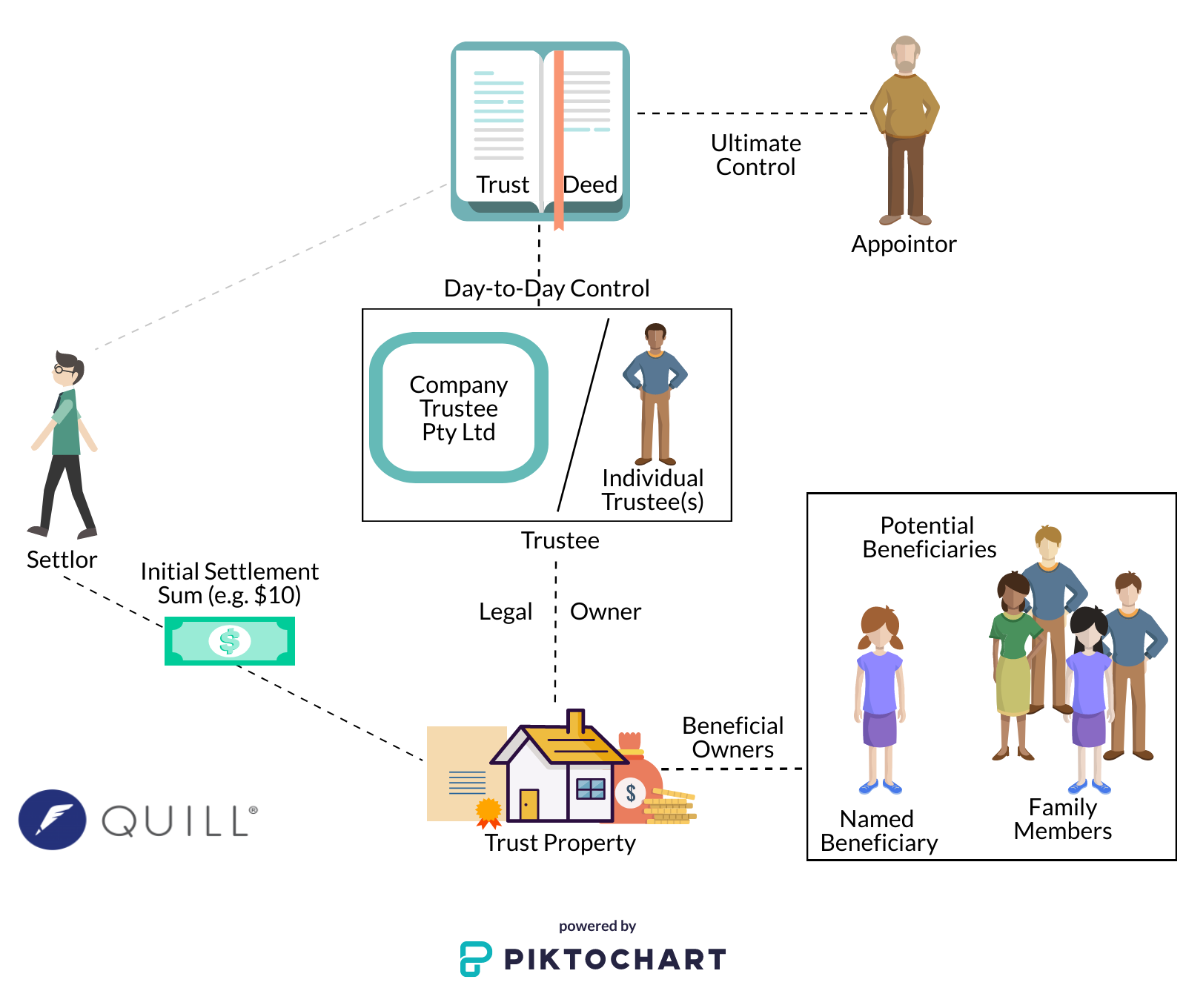

A unit trust allows for more than one family group to be involved in the fund.

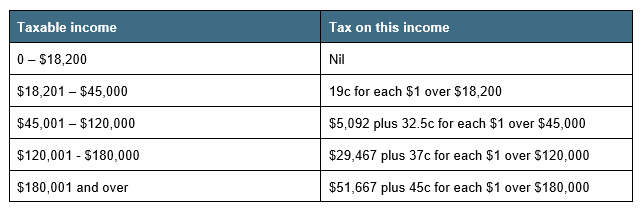

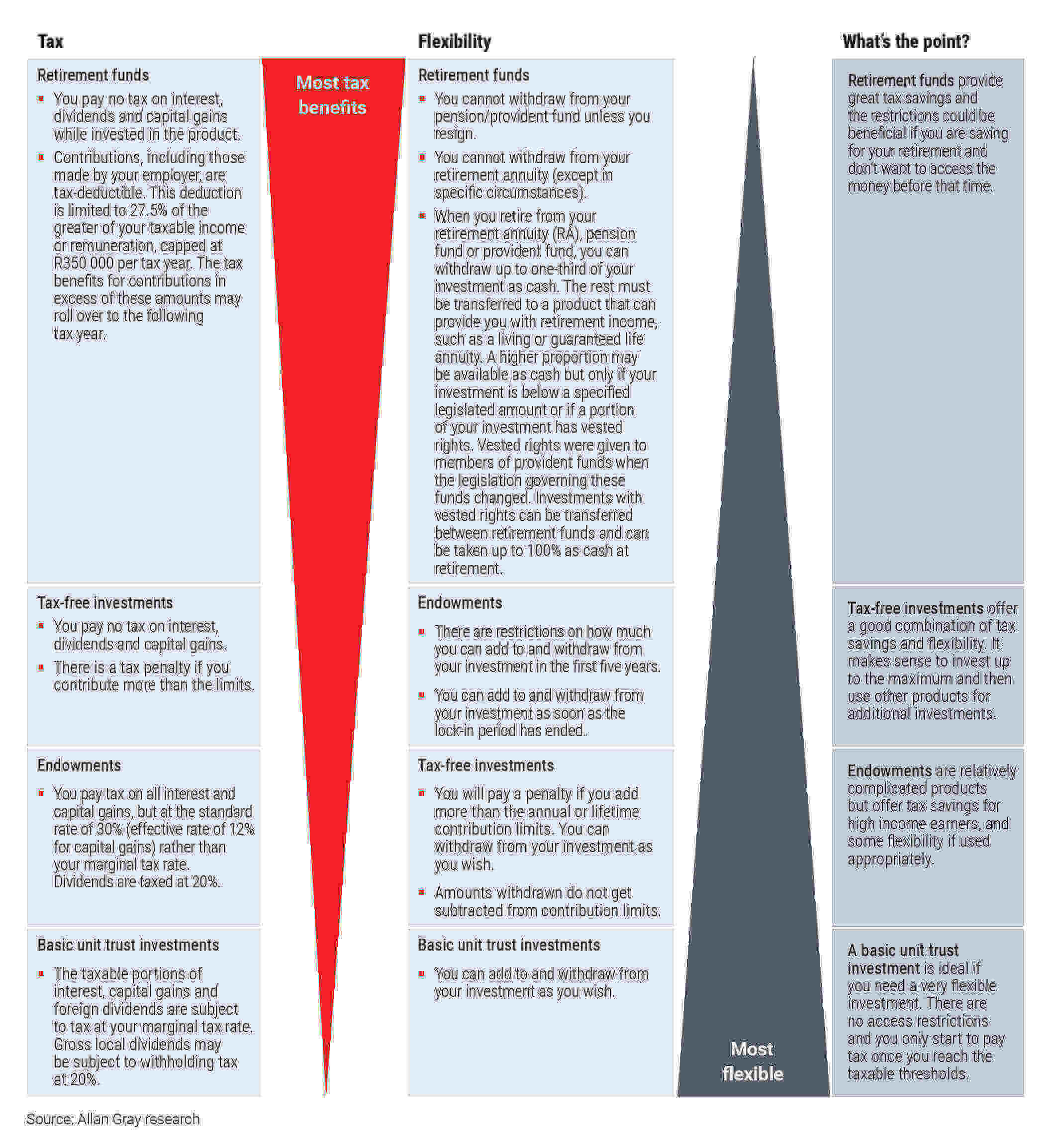

. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. The date you sell or dispose of an asset the CGT event.

This means you pay tax on only half the net capital gain on that asset. Disposal of a trust asset or another CGT event is likely to result in a capital gain or loss for the trust unless a beneficiary is absolutely entitled to the asset. The tax on the capital gain would be 37.

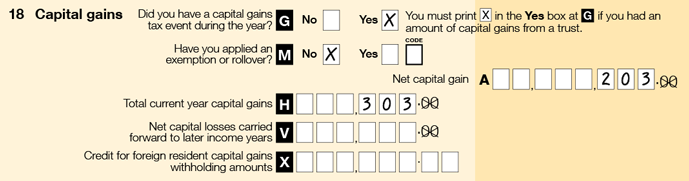

To calculate a capital gain or loss you have to determine if a CGT event has happened. Advantages of a trust. Capital gains and losses are taken into account in working out the trusts net capital gain or net capital loss for an income year.

Click here for tax rates for 2010 2011 and 2012 for both Australian residents and non-residents. This guide is not available in print or as a downloadable PDF. In Australia when investors sell shares and other listed securities for a price higher than they paid the profit or capital gain may be subject to a capital gains tax.

The marginal tax rates for individuals. Tax rates for a family trust. There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more.

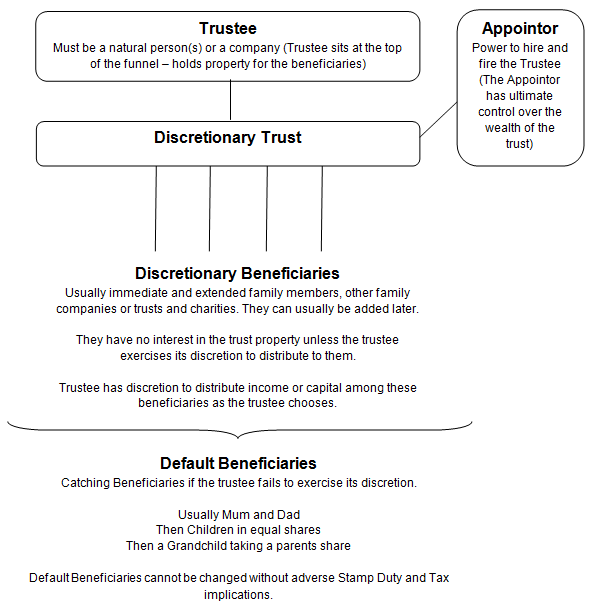

Taxation of trust net income non-resident beneficiaries. Capital Gains Tax CGT is the tax you pay on capital gains that arise from the disposal of shares. Accordingly when the beneficiary prepares their tax return they must include any trust distributions as part of their income.

A family trust typically pays zero tax on income from within the trust. The Guide to capital gains tax 2021 explains how capital gains tax CGT works and will help you calculate your net capital gain or net capital loss for 202021 so you can meet your CGT obligations. In most cases even though a CGT Event occurs you can disregard a capital gain or capital loss on an asset if the asset was acquired before 20 September 1985 known as a pre CGT asset.

The Australian Taxation Office ATO finalised Tax Determinations TD 201723 and TD 201724 on 13 December 2017Released in draft in November 2016 the Determinations consider certain aspects of the interaction of the capital gains provisions and the trust assessing provisions in Division 6 as those provisions apply to foreign trusts. Capital Gain Tax Rate. A capital gain or a capital loss will arise where a capital gains tax CGT event occurs or if another trust distributes a capital gain to you.

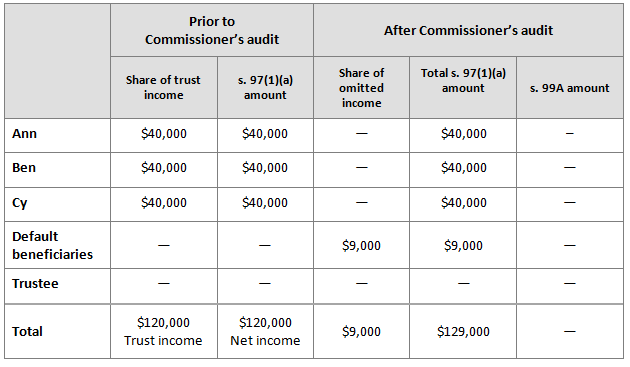

The ATO can cross-check the amounts distributed by the trust against the tax returns of the relevant beneficiaries. Somebody will pay tax on the net income of a trust. What is the capital gains tax rate on a trust.

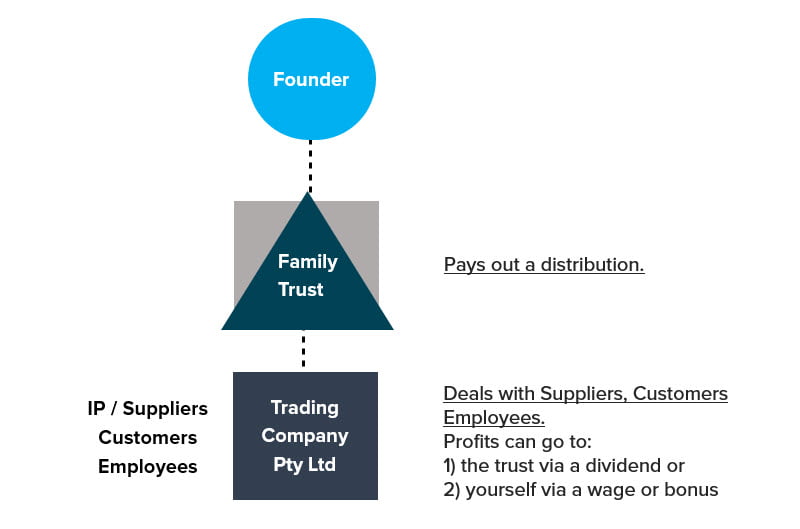

From a tax perspective the main advantage is that any income generated by the trust from business activities and investments including capital gains can be distributed to beneficiaries in lower tax brackets often spouses or children. Your current taxable income is 95000. Your taxable capital gain is 25000 with the 50 CGT discount applied Your estimated capital gain tax payable is 9750.

The taxation rate on these distributions is. Companies with a turnover greater than 5000000000. Including a 10000 capital gain in income would cost 3700.

You sold your investment property for 600000. At the beneficiarys tax rates. A trusts tax return is a data-matching tool for the Australian Taxation Office ATO.

However once the general 50 discount is deducted the taxpayer only declares 5000 capital gains income the tax on which at 37 is 1850. For capital gains over 6500 trusts and estates must pay a rate of 15 percent as opposed to a 20 percent rate on gains from those above 13000In order for capital gains realized on a trust to be credited toward a higher basis or administration to be avoided date of death values need to be obtained. Ss982A 983 on the net income of the trust attributable to Australian sources If the beneficiary is a trustee of another trust which has a non-resident trustee.

This treatment is similar to the way in which trustees are assessed in relation to a non-resident company or individual beneficiary. Namely the 50 CGT discount. An important point to note about trust distributions is that under the current tax law a trust must have resolved to distribute its annual income to its beneficiaries on or before 30 June each year to avoid the trustee being taxed on any undistributed income at the highest marginal tax rate.

Guide to capital gains tax 2021 About this guide. Your capital gain profit is 50000. Companies with a turnover less than 5000000000.

The effective tax rate on the capital gain of 10000 is 185. As part of the trusts net income or net loss the trust has to take into account any capital gain or loss. Australia Corporation Capital Gains Tax Tables in 2022.

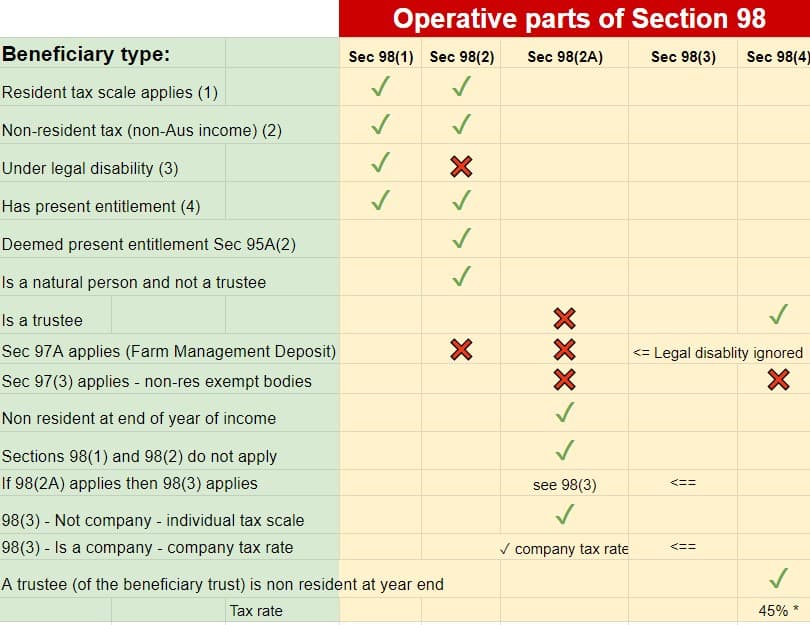

However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. Capital Gains Tax Advantages. Irrespective of who pays the tax be it the beneficiaries per s97 or s98A or the trustee per s98 income tax is assessed based on the trusts net income.

Disposal of a Trust Asset. Instead the income is distributed to the beneficiaries who are taxed at their personal tax rates. A flat rate of 30 for corporate beneficiaries.

Taxation of Capital Gains. Capital gains taxes are common globally but Australias implementation is considered one of the worlds most complex and the nuance in this regulation can have. The income tax rates on income earned from assets in a testamentary trust are the same as personal income tax rates.

And that net income is determined as if the trustee. You bought your investment property for 550000. Some assets are exempt from CGT such as your home.

The Income Tax Assessment Act 1936 ITAA 1936 ensures that a trustee is assessed on a non-resident trustee beneficiarys share of the net income of a trust. There are links to worksheets in this guide to help you do this. Additionally there are circumstances in which the trustee is liable to pay tax on behalf of the trust.

S984 then the trust pays tax on the beneficiarys share at 45 47 for the next 3. However the ATO allows income earned from assets in a testamentary trust to.

Non Assessable Payments From A Trust Australian Taxation Office

How Is A Family Trust Taxed In Australia Liston Newton Advisory

Capital Gains Tax On Shares In Australia Explained Sharesight

Rules For Non Resident Trustee Beneficiaries Australian Taxation Office

Trading Trust The Complete Guide Sewell Kettle Lawyers

Extra Conditions If The Cgt Asset Is A Share Or Trust Interest Australian Taxation Office

Trust Distributions The Relevance Of The Resolution To Tax Outcome Taxbanter

Discretionary Trusts And Tax Planning Tips And Traps William Buck Australia

End Of Financial Year Guide 2021 Lexology

A Brief History Of Australia S Tax System Treasury Gov Au

How To Set Up A Family Trust Quill Group Tax Accountants Gold Coast

Trust Law Discretionary Unit Trusts Lawyers Queensland Fc Lawyers

How Is A Family Trust Taxed In Australia Liston Newton Advisory

Trust Distributions The Relevance Of The Resolution To Tax Outcome Taxbanter

Allan Gray Part 2 How Can I Earn Higher Investment Returns And Pay Less Tax

Using A Bucket Company To Minimise Tax Liston Newton Advisory

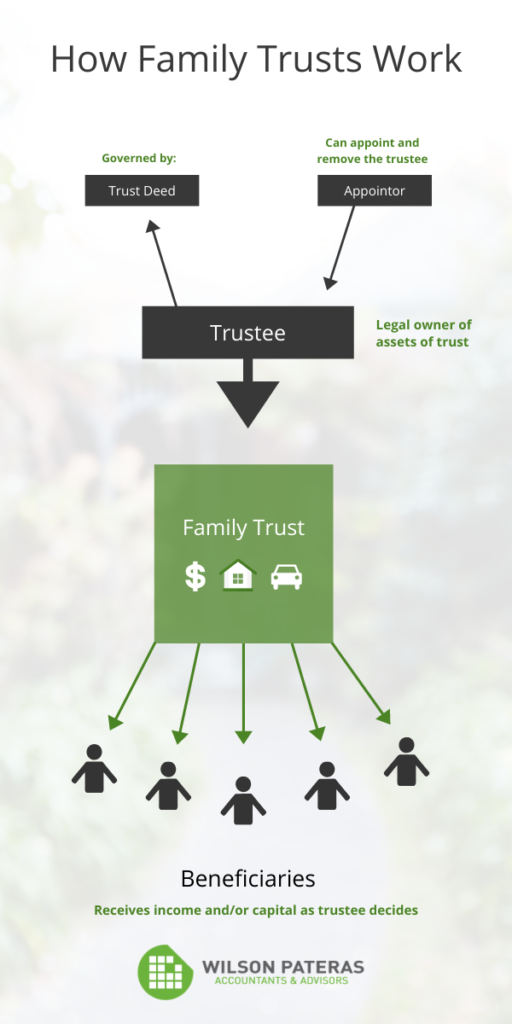

Family Trusts What You Need To Know

Including A Family Trust In Your Business Structure Fullstack Advisory

Here Is The List Of Some Of The Common Mistakes Which Bookkeepers Make In Filing Bas Statement Read More Http Www Ra Capital Assets Merchant Bank Bank Fees